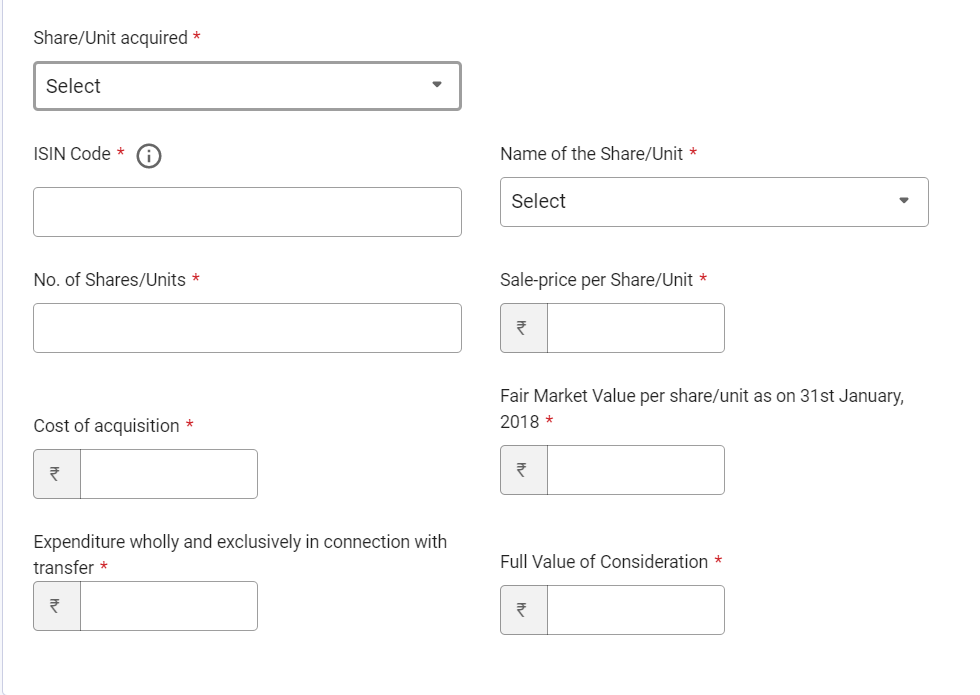

Understanding Section 111A and Section 112A of Income Tax Act: A Comprehensive Guide - Marg ERP Blog

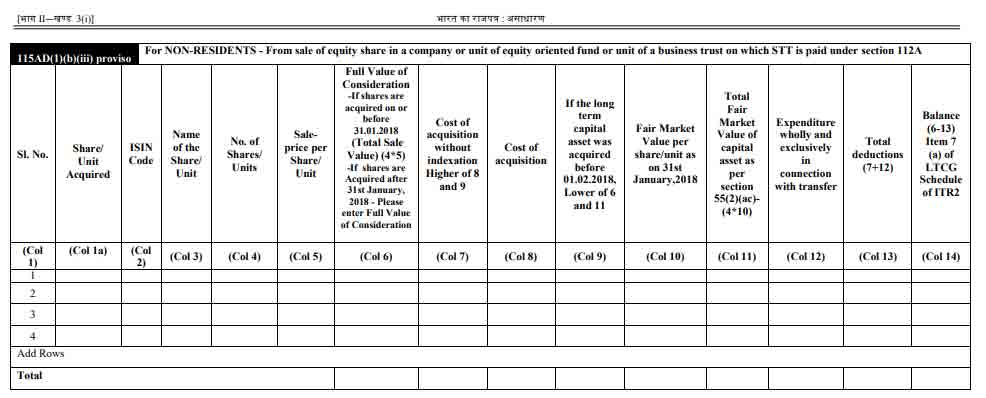

Section 112 a of Income Tax Act 2018 with Example |Long Term Capital Gain on Sale of Listed equity share | Latest Law and Tax Magazine and Books.

If you have any questions about tax harvesting please let me know in comments section, will reply to all comments.#march #tax #taxseason... | Instagram